The Biden Administration today announced that it would be forgiving up to $20,000 in federal student loan debt for students from low-income backgrounds, with $10,000 in forgiveness for all borrowers who make less than $125,000 in income. This Executive Order will provide needed relief for up to 43 million borrowers, and will provide Illinois borrowers of all ages, from college through retirement, with an estimated $12 billion in loan relief.

The Partnership for College Completion (PCC) joins the millions of borrowers in celebrating this announcement, as 90% of relief will go to people earning less than $70,000 annually. The income cap will make the distribution more equitable as well. Today’s executive action comes as only the latest of several steps this Administration has taken to ease the burden of debt for borrowers who have not realized the financial gains they had expected when they first took out their loans. This includes the student loan payment pause that has saved loan recipients $200 billion since March of 2020, and will now be extended through December 2022; the Public Student Loan Forgiveness program that has already forgiven 175,000 public servants’ loans; and the Administration’s discharge of $32 billion in debt for students who attended predatory for-profit colleges.

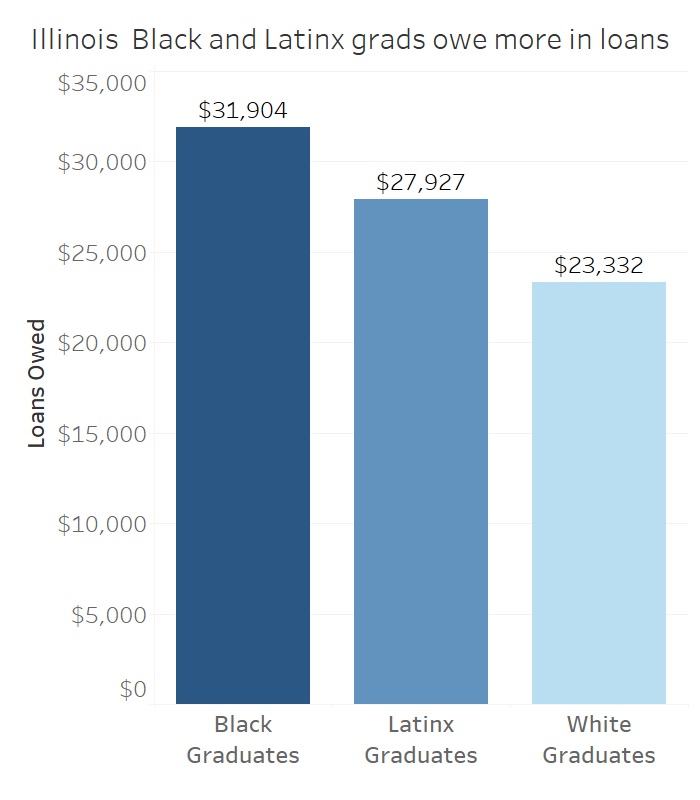

Still, debt forgiveness, while providing critical relief, will not lower the cost of college for current and future college students. At both the federal and state level, we need to transform the system that has pushed millions of students from low-income backgrounds to borrow large sums of money for the chance to earn a college degree. Biden’s loan forgiveness action itself tacitly acknowledges this: our current systems for funding higher education are unsustainable for students and families. The growth in student debt from $520 billion in 2006 to $1.73 trillion in 2021 is indicative of the unsustainably high cost of higher education that has proven a barrier to entry and persistence for students of color and students from low-income households in particular. This policy alone will not make college more affordable, and if we do nothing to attend to this underlying issue, national student loan debt will return to current levels after just four years.

In Illinois, our colleges and universities enroll 236,000 fewer students now than they did in 2010, and loan forgiveness won’t bring those numbers back up. What will reverse this trend, however, are policies that make college more affordable, and PCC and its partners will continue to advocate for those policies. Since its inception, PCC has called for more funding for Illinois’ student need-based aid program, the Monetary Award Program, and last legislative session saw an increased investment of $122 million in this critical resource. Right now, as part of the Commission on Equitable Public University Funding, PCC is working with partners across the state to answer how much additional funding universities need to equitably and adequately serve students, and how the state can institute a funding system that distributes funds to center those priorities. While these efforts may generate fewer headlines, they represent the kinds of policy changes that will help make college even more accessible and affordable for tens of thousands of additional Illinois students, along with the hundreds of thousands that enroll in our institutions every year working toward their college degree.

The Partnership for College Completion (PCC) champions policies, practices, and systems that increase college completion and eliminate degree completion disparities for low-income, first generation, and students of color in Illinois – particularly Black and Latinx students.